Understanding the Dutch Purchase Agreement (Koopovereenkomst)

Initially, the purchase agreement is a clear and straightforward contract. It is a standard template where only specific details are changed or filled in. These changes are usually made in a different font, handwritten, or crossed out. The purchase agreement protects the rights of both the buyer and the seller. It’s important to know that the basic structure of any purchase agreement is almost the same everywhere. Each agreement will include articles 1 through 20. Let’s go through these articles:

Page 1

The first page contains the details of both the buyer and the seller. Make sure to carefully check your own details. It’s important that they are all correct.

Article 1

- This section specifies the address of the property being sold.

- It includes the cadastral description of the property, such as Section A number 1234.

- Next is the size of the property. For example, 1 hectare equals 10,000 m², 1 are equals 100 m², and 1 centiare equals 1 m². So, a property of 10,210 m² is 1 hectare, 2 are, and 10 centiares.

- Lastly, it states the purchase price.

Article 2

- This article specifies who will cover the buyer’s costs, which are typically borne by the buyer when purchasing an existing property.

- It also states who will choose the notary, usually the buyer, unless otherwise agreed.

Article 2.2

If the property has changed ownership within the last 6 months, the tax authorities will refund the previous transfer tax. Normally, the seller is entitled to this money, but it is usually offset against the new transfer tax the buyer must pay. Therefore, the buyer receives the refund and must pass it on to the seller.

Article 3

All financial transactions go through the notary, who temporarily manages these funds in a special ‘escrow account’. The notary only transfers the purchase price to the seller once the property is registered in the buyer’s name and is free of mortgages, registrations, and claims. The deposit (10% of the purchase price) paid by the buyer will be adjusted in the final settlement, along with other costs like notary fees and municipal taxes.

Article 4

This section specifies the date for the key transfer at the notary. It also states that this date can be changed if both the buyer and the seller agree.

Article 5

The buyer must pay a deposit, which can also be done through a bank guarantee. This is usually 4 to 6 weeks after signing the purchase agreement. The amount is typically 10% of the purchase price. This deposit or bank guarantee acts as a security in case the buyer does not proceed with the purchase. We will discuss this further in Article 11.

Article 6

Article 6.1 This article is specifically for the buyer. It states that the buyer is responsible for knowing what they are buying. The property is transferred in its current condition, including all rights, claims, easements, and defects. For example, any rights of way or obligations related to the property. The buyer should review the property’s deed and cadastral extract, which should be provided by the seller.

Article 6.3 The property must be suitable for normal use at the time of key transfer. This means that toilets should flush properly, hot water and heating should work, and there should be no serious leaks. Issues already known to the buyer are excluded. For a fixer-upper, these problems will be mentioned in the sales brochure and during viewings.

Article 6.4 The seller must declare whether they know of any contamination, asbestos, old underground oil tanks, or soil contamination on the property.

Article 6.5 Just before the key transfer, the buyer has the right to inspect the property, which usually happens.

Article 6.6 The seller guarantees that no government-imposed improvements or repairs are pending on the property, such as significant subsidence requiring action.

Article 6.7 If the property is a listed monument or falls under protected city or village views, this will be stated. Remember that such properties may have restrictions on modifications.

Article 6.8 The seller declares that they have not promised or are not obligated to sell the property to someone else, such as giving an option to a neighbor.

Article 6.9 The seller confirms that they have not been required to offer the property to the municipality first, for example, if the municipality had plans for the land.

Article 6.10 If there are tenants in the property, they may be allowed to remove certain items like kitchen cabinets or showerheads before vacating.

Article 6.11 If the property’s size is stated as 100 m² but is actually 90 m², the buyer cannot claim any rights or financial compensation from the seller based on this discrepancy. However, in practice, this article may not hold up in court, and buyers may still claim compensation despite this clause. Sellers should measure the property accurately or be cautious when stating sizes.

Article 6.12 If there is ground lease, the seller must declare that they have paid the annual lease.

Article 6.13 If the seller claims they are unaware of asbestos and it is later discovered, they may still be liable. This is why there are clauses at the end of the purchase agreement, such as the asbestos clause, to exclude such liability.

Article 7

Article 7.1 Ownership of the property transfers with the handover of keys, usually at the notary’s office during the legal transfer. If there are still tenants or leased installations in the property, this should be mentioned.

Article 7.2 The property should be empty and cleared at the time of transfer, except for items agreed upon in the List of Items (e.g., curtains, wardrobes, refrigerators).

Article 7.3 After signing the agreement, the seller cannot place new tenants or enter into new lease agreements without the buyer’s permission.

Article 7.4 If the current owner has warranties on parts of the property (e.g., a new extension or dishwasher), these warranties transfer to the buyer. The seller should leave all warranty documents and related information for the buyer.

Article 8

From the day of key transfer, the buyer is responsible for municipal taxes, ground lease, and other charges. The notary will calculate and adjust these costs in the final settlement statement.

Article 9

If you buy or sell with a partner, this article ensures that after signing, both partners are authorized to fulfill the contract’s obligations. Each of you is individually liable to meet all terms of the agreement. For example, if you buy a property together and separate a week later, the seller can demand compliance from either of you.

Article 10

Until the key transfer, the seller is responsible for all risks and damage to the property, from a broken dishwasher to a fallen tree. If the property is lost (e.g., due to fire), the purchase agreement is canceled. After the key transfer, the buyer is responsible. Buyers should ensure they have home insurance at the time of key transfer, and sellers should keep the property insured until the transfer.

Article 11

This article outlines the penalties if parties do not meet their obligations. The seller must deliver the property at the agreed key transfer time. The buyer has two main obligations: to take possession of the property and to make the payment. Failure to do so can result in a significant penalty (10% of the purchase price). The deposit or bank guarantee mentioned in Article 5 serves as security for this.

Article 12

The purchase agreement and all important correspondence are filed with the notary. If the other party is hard to reach, you can always contact them through the notary.

Article 13

The parties can choose to register the purchase in the land registry. This costs around €150 to €200 and is usually paid by the buyer. Registration helps protect the buyer in case the seller faces financial issues, rents out the property, sells it to someone else, or has legal conflicts. Registration can be valid for up to 6 months.

Article 14

Buying or selling a property is a significant commitment. Parties must be able to prove their identity if requested. Identification is always required at the notary.

Article 15

This article lists the conditions for the agreement.

The Financing Condition

The most well-known condition is the financing condition. It specifies the amount and timeframe within which the buyer must secure financing. Sellers should be aware that buyers might request additional time to finalize financing. If the buyer cannot secure financing, they must prove this with at least one rejection from a recognized financial institution.

The Building Inspection

A building inspector provides a report on the property’s condition, noting defects, improvements needed, and immediate repair costs. It’s customary to agree on a threshold for repair costs. If the actual costs exceed this amount, the buyer may cancel the purchase. Additional specialist inspections might be required, especially if there are concerns about the floor or structural issues. If unexpected costs arise, parties often negotiate to avoid cancellation.

Article 16

The buyer has a statutory cooling-off period. If the buyer is a company, this period is not legally required but can be agreed upon.

Article 17

A verbal agreement is not legally binding for a property sale. The purchase is only finalized when both parties have signed the agreement. The signing often happens separately, with the seller usually signing first. The buyer must sign the agreement promptly after receiving it from the seller, typically within 5 working days.

Article 18

Dutch law applies.

Article 19

This article lists all documentation provided to the buyer, which usually includes:

- The deed of transfer

- The questionnaire B

- The energy label

- The List of Items

- The measurement report

- The cadastral extract

- The cadastral map

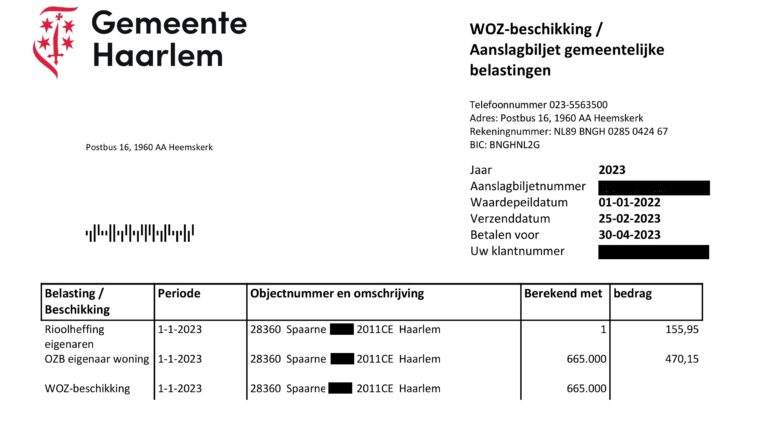

- A WOZ assessment

- The sales brochure

Buyers should carefully review all these documents to understand what they are purchasing, including any rights and obligations.

Article 20

Additional agreements between the buyer and seller can be mentioned here, such as the seller removing an old shed from the garden.

Article 21 and Beyond

From Article 21 onwards, various clauses are listed. The seller often protects against:

- Asbestos

- Soil contamination

- Foundation defects

- The age of the property and related issues

- Buyer’s due diligence

- Differences between actual measurements and the measurement report (though this may not hold up in court)

- Fluctuating groundwater levels

- Issues like tenant rights or property use

- The requirement for the buyer to occupy the property and not rent it out

Acknowledgment of Receipt

At the end of the purchase agreement is the acknowledgment of receipt, which the buyer must fill out and sign. This marks the start of the cooling-off period.

List of Items

The agreement usually includes a List of Items, which both parties must sign.

Ready to kick-start your real estate journey?

Enroll in our Dutch Expat Realtor Training today!